Conference Schedule

Expert know how you can immediately apply.

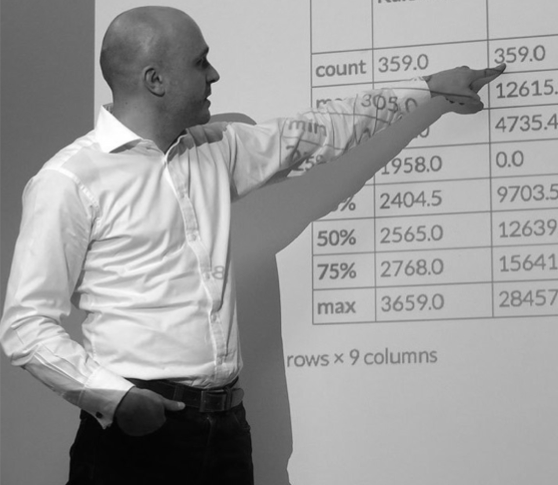

This talk illustrates the benefit of deploying and using Python via the browser.

kdbpy is a library for writing queries against the kdb+ database from Python. It leverages blaze to generate expressions, gives pandas DataFrames as the output format and uses qpython for communication with q over a tcp socket. It enables users to write a large subset of qsql from the comfort of their own Python interpreter and is one of many backends to come out of the blaze+pydata ecosystem.

I'll discuss a few quirks of the q language (for people unfamiliar with the language), what motivated kdbpy's creation and some details of how kdbpy leverages blaze to generate expressions.

Close

It is complex, costly and risky to deploy heterogeneous open source components across an organization. Web-based technologies allow for a central, unified deployment with end users only needing a (current) browser. Such a strategy facilitates introduction and maintenance of Open Source components for Quant Finance.

Yves illustrates such a systematic deployment strategy by some use cases based on the Quant Platform (cf. http://quant-platform.com) and datapark.io (cf. http://datapark.io).

Close

As Python gains acceptance, many financial companies have

started building models in Python for risk management. In this talk, we will discuss the key aspects of model verification and validation and introduce a novel approach to do stress and scenario tests leveraging parallel and distributed computing technologies and the cloud.

We have developed a platform that leverages cloud based technologies to run stress tests on a massive scale without having to invest in fixed in-house architectures. Through a Python based case study, we will illustrate best practices for stress and scenario testing for model verification and validation. These best practices meant to provide practical tips for companies embarking on a formal model risk management program or enhancing their model risk methodologies to address the new realities specifically when building models in Python.

Close

More and more financial modelling and analysis is moving away from monolithic "big-BI" tools towards custom programmatic backends like Python and Pandas. As powerful as this workflow is, it lacks a rich presentation and sharing layer like R's Shiny Apps or Tableau's dashboards. It's time for that to change.

Chris Parmer, Plotly's Co-founder and Chief Product Officer, will demonstrate how to build rich, interactive financial analysis web-apps with Flask, Pandas, and Plotly's d3.js based graphs with just a couple hundred lines of code.

Close

This talk will review techniques for sourcing and combining uncorrelated returns streams to achieve consistent market outperformance. We consider backtested and simulated return streams from systematic (but opaque) algorithmic trading strategies sourced from "the crowd" as a novel asset class.

The discussion will focus on the construction of uncorrelated portfolios from trading algorithms entered into the "Quantopian Open" online trading competition.

Close

Quant teams can be incredibly productive, but to do their best work they need a platform: tools to write & test code, the ability to share code & data with others in the team, relevant data in a form they can easily access and write to, standard financial models & analytics to build on top of, a way to run automated daily jobs, access to large-scale grid compute, the ability to expose their work through applications, and a controlled production environment that protects their organization while allowing for iterative new development.

We discuss what we think is the best architectural model for such a platform, with examples from our implementation, Washington Square Technologies's Beacon platform.

Close

"Roads? Where we're going, we don't need ... roads."

No five year old ever says they want to grow up to "build a hedge fund". But maybe if they knew how easy it was and that if they did really well, they could get way more toys — then maybe they would. Thanks to nearly free and infinitely scalable ubiquitous computing, vast open source libraries and datasets, and the amazing abilities of modern languages, especially Python, the barrier to entry to actually building what is needed to run a hedge fund has never been lower. Python has afforded the ability to go from idea to inception to managing risk quicker than ever before.

Close

The Python financial ecosystem is an incredibly useful collection of related tooling built around a common set of ideas and practices. At Elsen, we are looking to augment the IPython notebook as the next generation accelerated research platform supporting the ability to scale research to arbitrary cloud resources and explore enormous amounts of market data all from the comfort of the existing ecosystem.

Close

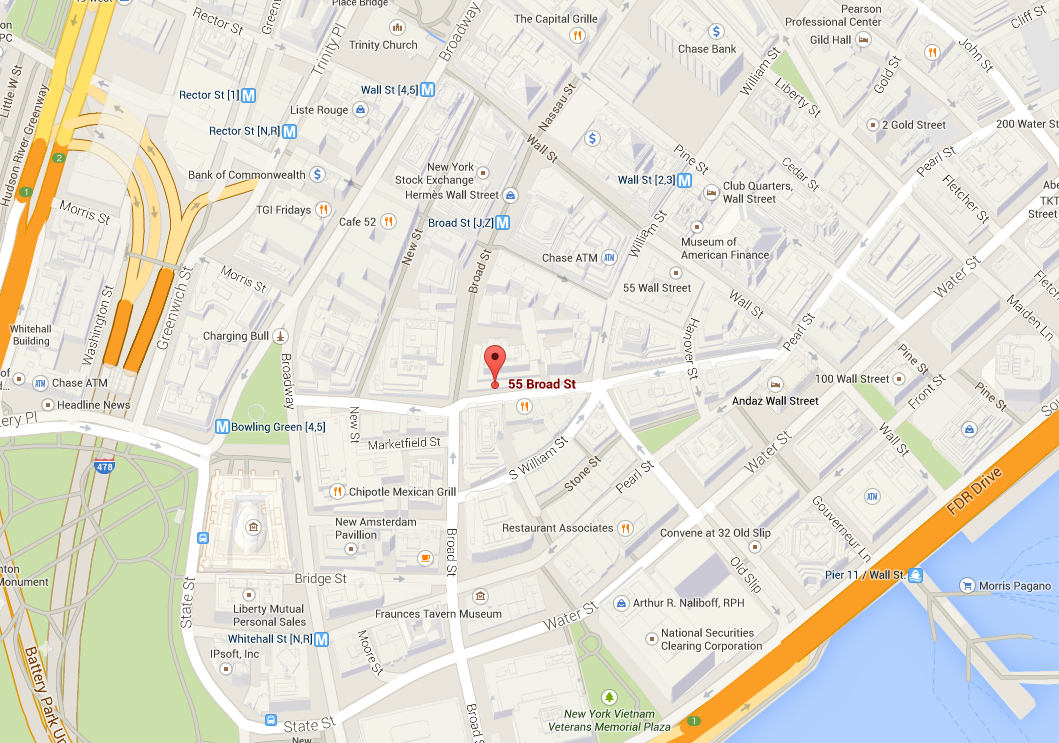

| 8:00 |

|

Registration and Morning Coffee |

|

|

WELCOME & OPENING REMARKS |

| 9:00 |

Dr. Randeep Gug

CQF Institute |

Welcome and Opening Remarks |

| 9:10 |

Dr. Yves Hilpisch

The Python Quants |

Open Source in Quant Finance — The Revolution |

|

|

DATA & VISUALIZATION |

| 9:30 |

Phillip Cloud

Continuum Analytics |

kdbpy: Readable q via Blaze (Abstract) |

| 10:10 |

Chris Parmer

Plotly |

Building Web-based Financial Visualization Dashboards with Pandas, Flask, and Plotly (Abstract) |

| 10:50 |

|

MORNING BREAK |

|

|

BROWSER & CLOUD |

| 11:20 |

Stephen Diehl

Elsen |

Using High Performance Computing with IPython in Finance (Abstract) |

12:00 |

Sri Krishnamurthy

Quant University |

Scaling Python Models for Model Verification and Stress Testing on the Cloud (Abstract) |

| 12:40 |

|

LUNCH BREAK |

|

|

|

PLATFORMS & TRADING |

| 13:30 |

Dr. Mark Higgins

& Kirat Singh

Washington Square Technologies |

A Batteries-Included Quant Platform:

Scaling Python-Based Analytics and Data (Abstract) |

| 14:10 |

Jessica Stauth, PhD

Quantopian |

Crowd-sourced Alpha: The Search for the Holy Grail of Investing (Abstract) |

| 14:50 |

|

AFTERNOON BREAK |

|

|

|

DEPLOYMENT & APPLICATIONS |

| 15:15 |

Dr. Yves Hilpisch

The Python Quants |

Open Source Deployment via the Browser (Abstract) |

| 15:55 |

Adam Sherman

ARC Investments |

Building a Hedge Fund with Python (Abstract) |

|

|

PANEL DISCUSSION, RAFFLE, CLOSING REMARKS |

| 16:35 |

Expert Group |

What Role will Open Source Play in the Future of Quant Finance? |

| 17:10 |

|

Book Raffle sponsored by O'Reilly & Wiley and Closing Remarks |

| 17:30 |

|

Conference Closing, Get Together |